Aims to achieve long-term capital growth through investing in Saudi equities and IPOs in the Saudi stock market.

Seeks to realize long-term capital growth through investing in Shariah-compliant Saudi equities and IPOs in the Saudi stock market.

Pursues long-term growth through diversified investments in equities listed in MENA Markets.

Targets long-term capital growth through investing in high concentration Shariah-compliant Saudi equities and IPOs in the Saudi stock market.

Focuses on securing long-term capital growth through investing in Shariah-compliant Saudi small and medium capital listed companies in Saudi stock market.

Seeks to achieve long-term capital growth through investing in Shariah-compliant Saudi equities and IPOs in the Parallel Market (Nomu).

Aims to generate steady capital growth, while maintaining adequate liquidity, by investing in a diversified mix of Shariah-compliant financial instruments.

On a mission to provide the unit holders with periodical income through investing in a portfolio of diversified Shariah-compliant assets.

Invests in diversified portfolio of Fixed Income instruments and Money Markets tools. To achieve the balance between capital preservation and positive returns.

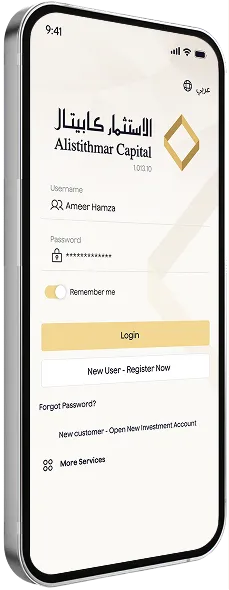

From Riyadh to Wall Street, access global opportunities in U.S., GCC, Jordan and Egypt in just a few taps.

Find the latest updates, press releases, and media coverage about

Alistithmar Capital in one place.

Alistithmar Capital is ranked 6th in Forbes Middle East's ranking of the largest asset managers in Saudi Arab ...

Alistithmar Capital is ranked 6th in Forbes Middle East's ranking of the largest asset managers in Saudi Arab ...

Alistithmar Capital is ranked 6th in Forbes Middle East's ranking of the largest asset managers in Saudi Arab ...

Alistithmar Capital is ranked 6th in Forbes Middle East's ranking of the largest asset managers in Saudi Arab ...

Alistithmar Capital is ranked 6th in Forbes Middle East's ranking of the largest asset managers in Saudi Arab ...